Inflation, the rise in prices for goods and services, has many effects on one’s financial situation. The primary effect of inflation is that it reduces the purchasing power of consumers and businesses. On the other hand, inflation can encourage spending and investing activities as well as reduce unemployment. However, inflation also impacts an individual’s taxes. This article will highlight some of these instances.

Inflation, the rise in prices for goods and services, has many effects on one’s financial situation. The primary effect of inflation is that it reduces the purchasing power of consumers and businesses. On the other hand, inflation can encourage spending and investing activities as well as reduce unemployment. However, inflation also impacts an individual’s taxes. This article will highlight some of these instances.

In November 2021, inflation rose 6.8% from the same month in 2020. This was the fastest increase since 1982. The price for new cars has risen 11% and prices at restaurants have risen by 7.9%. With the rise of prices for various goods and services comes the adjustments for inflation for wage earners, retirement savers, social security recipients.

While the income of taxpayers in the 1970s had risen with inflation to account for the cost of living, tax brackets have remained static. Thus, during the 1970s, taxpayers were owing more taxes on additional income, which also caused a decrease in purchasing power. Inflation indexing, or the automatic cost-of-living adjustments built into tax provisions to keep pace with inflation, was enacted in 1981, after several years of inflation and rising prices. Congress indexed the income-tax brackets and a handful of other tax provisions for inflation. However, not all tax provisions have been indexed.

Two key provisions that have not been indexed for inflation for home buyers and sellers are the $750,000 cap on total mortgage debt where interest is tax-deductible, and an exemption of up to $250,000 of profit for single filers and $500,000 for married couples on the sale of a home.

If the gain exemptions on the sale of a home were adjusted for inflation, it would significantly increase to $411,000 for single filers and $822,000 for joint filers. A taxpayer that has significant taxable gain from the sale of an appreciated home will owe higher taxes due to inflation. The home-sellers exemption was enacted in 1997 and is in dire need of an adjustment for inflation in the current economic environment and the escalation of housing prices in recent years.

Wage-earners will see their net income (take-home pay) increase in 2022. This is due to the inflation factor used to adjust the federal tax withholding tables has increased by 3% for 2022. The inflation factor increased because of the adjustment of the inflation indexing. This increase lowers the amount of taxes deducted from paychecks and results in more money in taxpayers’ pockets.

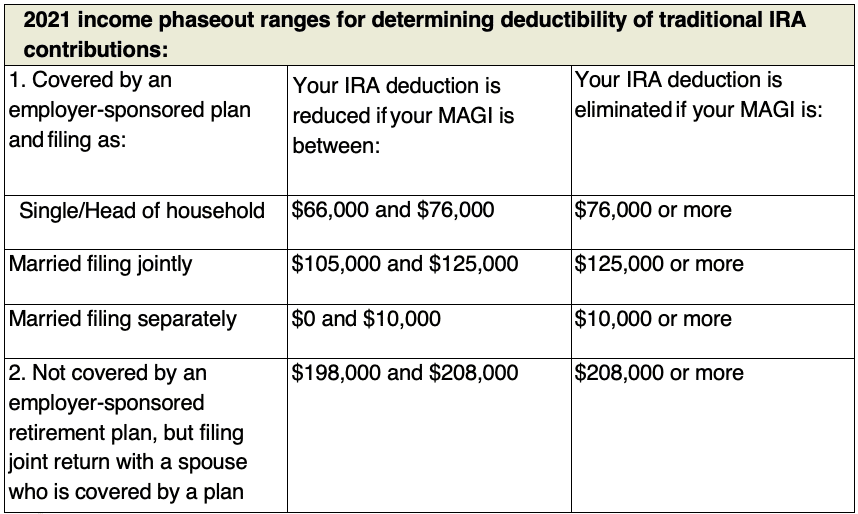

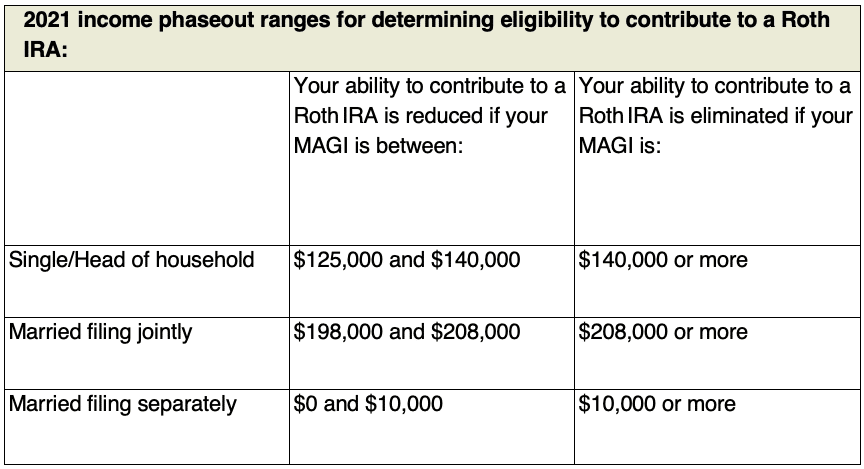

Additionally, people who are saving for retirement will benefit from the change in the inflation factor because the inflation factor for a retirement plan uses a different inflation index than for wages and is more beneficial. The top tax-deductible contribution to a 401(k) for savers under age 50 will rise to $20,500 from $19,500 in 2021. However, Traditional and Roth IRAs will not see an increase in the contribution limit. However, people over age 50 can make an additional $1,000 contribution to a Roth or Traditional IRA.

Lastly, higher inflation will also increase Social Security benefits for 2022 by 5.9%, the most since 1982. The increase in the benefits will also result in increased taxes for recipients. The income thresholds where 85% of Social Security payments become taxable have not been adjusted for inflation since 1994. The income threshold for joint-filing couples is $44,000 whereas for single filers it is $34,000.

If the thresholds were adjusted for inflation, they would be about $80,400 for couples and $62,200 for singles in 2022. See our previous article on the Cost-of-Living Adjustment (COLA) for social security recipients for a more detailed explanation.

In sum, while several provisions of the tax code take inflation into account, other provisions remain unaffected.

If you have any questions regarding the information in today’s blog post, contact your trusted advisor at RVG & Company, today! (954) 233-1767.