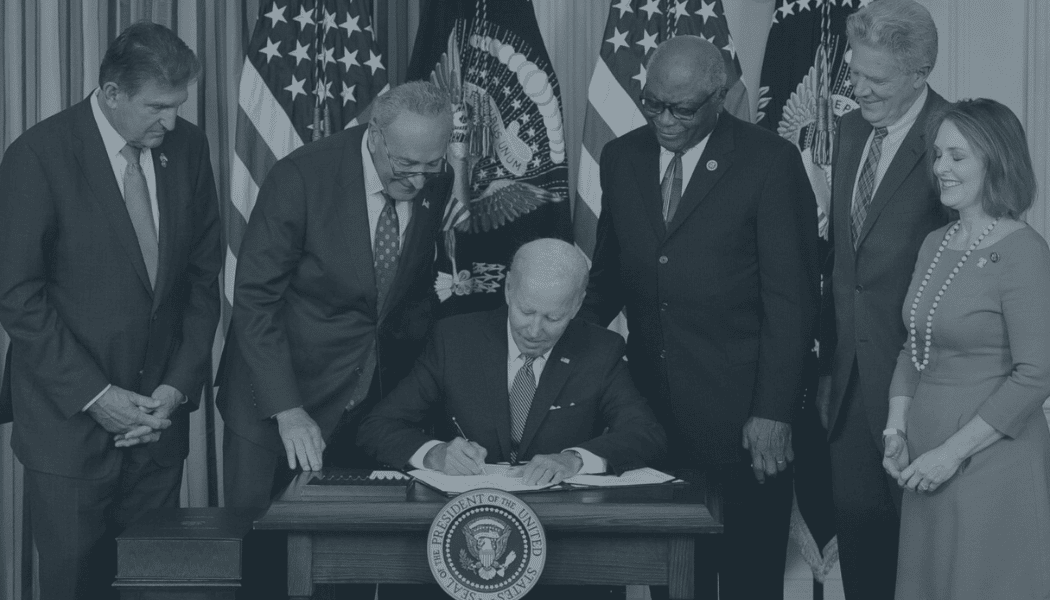

President Biden Signs Inflation Reduction Act of 2022

On August 16, 2022, President Biden signed the Inflation Reduction Act (“Act”) into law. The legislation contains significant changes related to tax, climate change, energy, and health care. The new law is expected to raise approximately $222 billion over $10 years. As an overview, the Act includes a 15% corporate alternative minimum tax (AMT), a 1% excise tax on stock buybacks, a two-year extension of the excess business loss limitation rules, and additional funding for the IRS. The Act also contains several energy-tax incentive provisions.

It should be noted that the Act does not increase individual tax rates, capital gains rates, change the estate and gift tax rules, eliminate the tax-free IRC § 1031 real property exchange, or limit the tax benefit of IRC §1202 – the gain exclusion for owners of small businesses.

Summary of Tax the Provisions

15% AMT:

The Act imposes a 15% corporate AMT on large corporations that have an average of $1 billion of income based on their financial statements for a three-year period. The AMT is effective for tax years beginning after December 31, 2022.

Excise Tax on Corporate Stock Buybacks:

The Act levies a 1% tax on stock repurchases by publicly traded corporations. The tax applies to repurchases of stock after December 31, 2022. The tax is imposed on the fair market value of the stock repurchased by the corporation during the tax year, reduced by the value of stock issued by the corporation during the tax year.

Extension of Excess Business Loss Limitation Rules (EBLL):

Under this provision, the deduction of business losses of a non-corporate taxpayer is limited. The Act extends this limitation until December 31, 2028. Before the Act, the limitation was set to expire at the end of 2026. Under the EBLL, taxpayers may not deduct an excess business loss against other nonbusiness income (generally, net business deductions over business income) if the loss exceeds $250,000 ($500,000 in the case of a joint return). The excess loss becomes a net operating loss in subsequent years and is available to offset 80% of taxable income each year.

Enhancement of IRS Resources:

The Act will allocate $80 billion to IRS enforcement and administration over 10 years. The resources will be focused on: (i) Taxpayer Services – such as filing assistance, account services, and taxpayer advocacy; (ii) Enforcement – hiring additional IRS field agents, expansion of exam technology, and increasing the rate of audits and criminal investigations; and (iii) Operations & Administration – this includes the improvement of offices, telecommunications, technical research, security, and information technology development.

Energy & Climate Tax Credits:

The Act provides not only new energy tax incentives, but also provides new means to deliver them. In some instances, the Act allows direct payments from the federal government to taxpayers in lieu of tax credits. In other instances, the tax credits can be transferred, or sold, to other taxpayers. Some of the notable credits are:

- The Production Tax Credit – This is for renewable electricity production.

- Investment Tax Credit – This is for the installation of renewable energy property.

- Carbon Oxide Credit – The Act expanded the credit for capturing each metric ton of qualified carbon oxide using special equipment.

- Other Fuel Credits – The Act also provides for the broadening of credits for biodiesel and sustainable aviation fuel along with a new credit for clean hydrogen production.

RVG & Company

If you would like to discuss the potential impact that the Act may have on you, or possible tax strategies please contact your Trusted Advisor at RVG & Company at 954.233.1767.