Everything You Need to Know about Form 1099

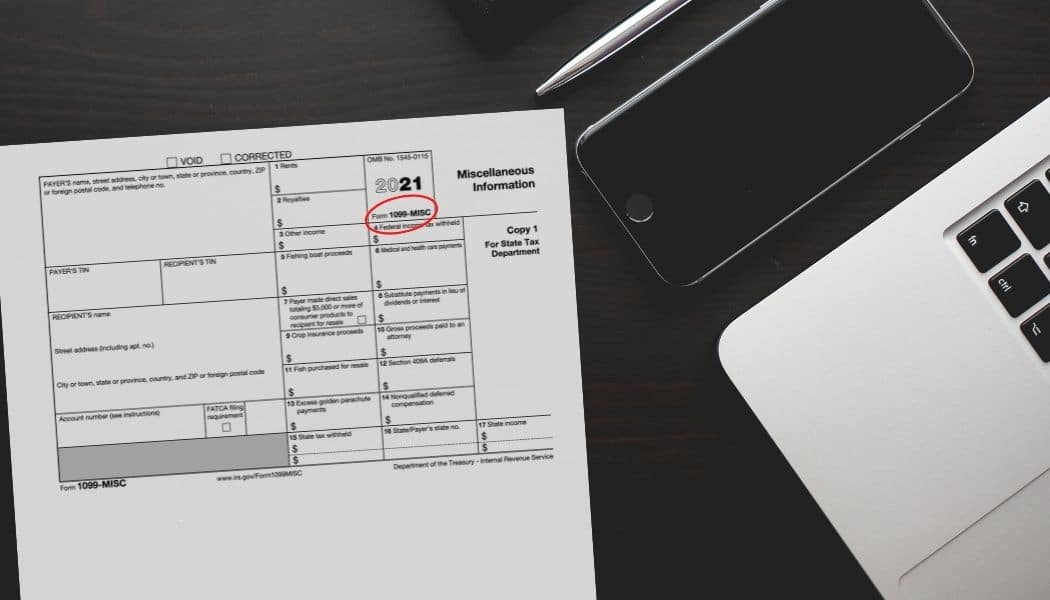

IRS Form 1099 reports a taxpayer’s income that does not come from wages, salaries, or tips from a main employer. It is an informational return and does not need to be attached to an individual’s tax return. However, it is recommended to keep a copy of the form for a taxpayer’s personal records. There are two dozen versions of Form 1099, and each lists a different type of income. Form 1099 is used to determine how much income a taxpayer received during the tax year and what kind of income it was. A taxpayer will have to report that income in various places within the tax return, depending on the type of income that is reported.

To be eligible to receive Form 1099, a taxpayer’s income needs to be above a certain amount depending on the type of Form 1099. For the 1099-INT, 1099-DIV, and 1099-R, a taxpayer should receive a form if there was at least $10 or more of income to report. Whereas for Form 1099-MISC, a taxpayer should receive a form if there was at least $600 or more of income to report. Again, it all depends on the type of Form 1099. A taxpayer will not receive a Form 1099 if the income is below the threshold, however, the income should still be included in the tax return.

It should be noted that receiving a 1099 form does not necessarily mean that taxes are owed on that income. A taxpayer may have deductions that offset the income or some or all of it might not be subject to tax based on characteristics of the asset that generated it.

Companies and institutions are required to send most 1099 forms by January 31st following the tax year. Income earned, for example, in 2021 would be reported in a Form 1099 that a taxpayer should receive by January 31st, 2022, from the payor. If a taxpayer has opted to receive forms digitally, the digital version should be shown on your account on January 31st, or first thing on February 1st.

If a taxpayer receives physical copies of their tax forms, the taxpayer’s forms need to be postmarked in the mail by January 31st. If that date falls on a weekend or holiday, it should be available on the next business day. There are, however, a few exceptions: Form 1099-B, 1099-S, and some 1099-MISC forms must be postmarked by February 16, 2021.

The payor may send a consolidated Form 1099 if sending multiple versions of Form 1099, to a taxpayer that has distinct categories of income with the payor. A Consolidated Form 1099 is common for people who have investment income, capital gains, and brokerage accounts containing investments in either mutual funds or Real Estate Investment Trusts (REITs). A taxpayer should receive a consolidated Form 1099 Form by February 16th following the tax year.

If a taxpayer does not receive their Form 1099, the payor responsible for sending the form must be contacted. If a taxpayer needs to file a previous year’s tax return and is missing their old Form 1099, a free copy can be provided by the IRS by requesting a wage and income transcript. It should be noted that the IRS receives copies of Form 1099 that are sent to taxpayers. As a result, the IRS will cross-reference the Forms provided by payors to the income reported on individual tax returns. A taxpayer’s failure to accurately report Form 1099 income can be easily detected and adjusted by the IRS.

If a taxpayer does not receive their 1099 forms in time to file their tax return, a request for a penalty-free six-month tax extension is available by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. To receive the extension, the taxpayer must estimate their tax liability on this form and should also pay any amount due.

If you have any questions regarding 1099 Requirements or other obligations, please contact RVG & Company, today! (954) 233-1767.