As virtual currencies such as Bitcoin and Ethereum become more widely established as an investment vehicle and manner to pay for goods and services, the IRS is increasing its scrutiny.

Recent IRS Developments with CryptoCurrency

The IRS has been monitoring issues related to virtual currency since 2014 when it issued Notice 2014-21. The Notice explained (in 16 frequently asked questions) how existing tax principles apply to transactions involving virtual currency. In short, the IRS considers it property. When virtual currency is sold or used to purchase goods and services, taxpayers must compute their gain or loss stemming from the virtual currency. As a result, taxpayers must track their basis in the virtual currency and determine its fair market value when they sell it or use it in a transaction.

Recently, the IRS has provided guidance on virtual currency by updating Notice 2014-21. Moreover, the IRS has issued summonses to two cryptocurrency exchanges to obtain information regarding their customer’s virtual currency transactions. We will discuss each of these items below.

It should also be noted, that on May 20, 2021, the U.S. Treasury announced a proposal to monitor cryptocurrency markets and transactions. This would require any transfer worth $10,000 or more to be reported to the IRS. This initiative is being developed as part of the President’s policy to increase IRS compliance measures and resources under the tax provisions of the American Families Plan. The Treasury believes that this requirement would deter the use of cryptocurrency to facilitate illegal activity and tax evasion.

IRS Revision to Notice 2014-21

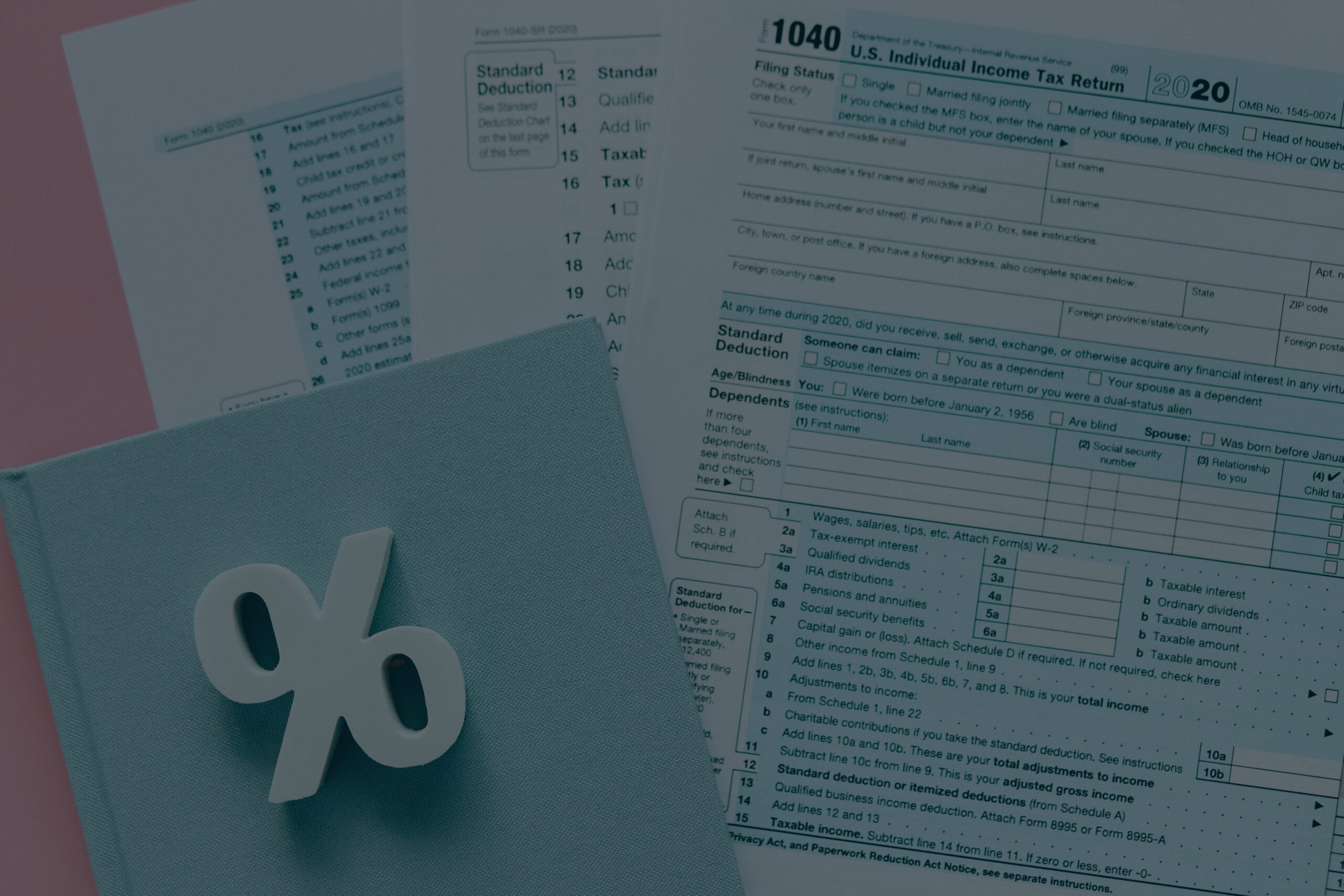

On March 2, 2021, the IRS updated FAQ number 5 in Notice 2014-21. The new guidance relates to the “Yes” or “No” question that is now prominently on page one of Form 1040 of the individual income tax return. The question is just below the taxpayers’ name and address. Previously, this question was on Schedule 1.

The revised FAQ provides that taxpayers whose only crypto transactions include the purchase of virtual currency with real currency need not answer yes to the question on Form 1040. This guidance is contrary to the plain reading of the question on the tax return, which asks, “at any time during 2020 did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?” It should be noted that an FAQ cannot be relied upon by a taxpayer.

Regardless of this potential conflict between the tax return question and the FAQ’s guidance, the fact that the IRS conspicuously placed the virtual currency question on page one of the 2020 individual tax return and revised FAQ 5, demonstrates the heightened level of scrutiny on this issue. In short, the IRS is raising taxpayer awareness about the potential income tax consequences from virtual currency transactions. Back in 2014, the IRS noted that virtual currency is property, and gains related to it must be included in income.

IRS Summonses for Virtual Currency Records

In April of 2020 and May of 2021, federal district court judges permitted the IRS to serve “John Doe summonses” on two financial institutions that administer cryptocurrency exchanges. A “John Doe summons” is a mechanism through which the IRS, with court approval, can compel information from a third party concerning a taxpayer or class of taxpayers that are not identified by name in the summons. To obtain the summons, the IRS must demonstrate: (1) an ongoing investigation, (2) it reasonably believes that the taxpayers did not comply with the law; and (3) the information is not available from other sources. The IRS previously used this summons process in the early 2000s to crackdown on abusive offshore banking and bank secrecy in Switzerland. On April 1, 2020, the U.S. District Court for the District of Massachusetts allowed the IRS to serve a John Doe summons on Boston-based Circle Internet Financial Inc. and its affiliates, the administrators of a widely known cryptocurrency exchange called Poloniex. In a separate matter, on May 6, 2021, a federal court in the Northern District of California authorized the IRS to serve a John Doe summons on Payward Ventures, the administrators of the Kraken cryptocurrency exchange.

In both orders, the John Doe summonses seek information regarding U.S. taxpayers who conducted transactions in cryptocurrency totaling at least $20,000 in any one year during the years 2016 to 2020. Also, the IRS is not focusing on the cryptocurrency exchanges, rather, it is the potential individual taxpayers that are the focus of these investigations. It should also be noted, that in March of 2021, the IRS Office of Fraud Enforcement announced the launch of “Operation Hidden Treasure” to find tax evasion related to cryptocurrency. In this regard, the IRS is also proposing to issue John Doe Summonses in New York and Colorado. The two-fold goal is to uncover tax evasion and illegal transactions that are paid for with virtual currency.

Conclusion

Based on recent steps taken by the IRS, taxpayers should track and report virtual currency transactions with respect to direct investments in it and purchases of goods and services made with a cryptocurrency. Also, as the use of cryptocurrency grows, financial institutions may be required to track these transactions in a similar manner as stocks, bonds, and other investments that are reported to the IRS.